Mortgage Quote Impact from New Loan Level Pricing Adjustments (LLPA).

Key Takeaways:

- Mortgage Quotes have fees called “Loan Level Pricing Adjustments (LLPA)” that can raise or lower your mortgage rates.

- These fees are add-on adjustments by Fannie Mae, Freddie Mac, and Lenders when establishing mortgage rates.

- Loan Level Pricing Adjustments adjust your mortgage rates (up or down).

- Credit scores, debt-to-income ratios, loan-to-value, property type (single-family/multi-family/condo, etc.), and loan purpose (purchase, refinance, construction, and cash-out) are typical mortgage rate adjustment categories.

- Use of property also can increase or decrease your mortgage rate.

- The Down Payment amount can increase or decrease your mortgage quote.

- First-Time Homebuyers could see benefits from loan program adjustments.

Due to loan-level pricing adjustments (LLPA), the mortgage rate quote you rely upon when applying for a mortgage might differ from the actual rate you receive.

An advertised mortgage rate is usually based on the “best case at a given moment.” Lots of (very) small print (or a ridiculously fast-talking audio ad) will describe the factors used for the quote (and often why they can’t deliver it)!

Advertised mortgage rates exist to generate a consumer response (to get you to contact the lender and start an application).

Mortgage Rate Quote

It can be difficult for a mortgage lender to accurately quote a mortgage rate at the beginning of the process, and here’s why:

Loan Level Pricing Adjustments.

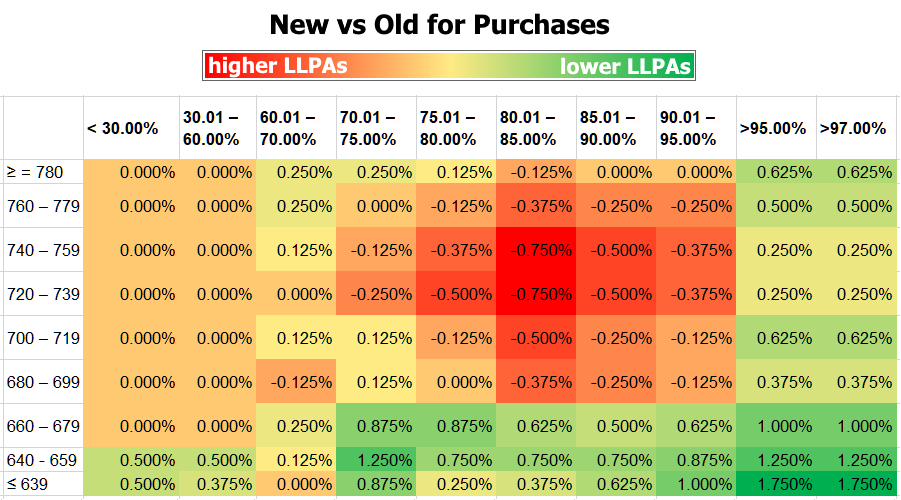

Here’s a heat map that shows the new adjustments from FNMA. (source: Mortgage News Daily)

As you can see on the heat map, the adjustments vary (and the green categories IMPROVE the adjustments from previous levels)

Here’s a link to FNMA showing their adjustments in detail.

Sometimes, married/partner clients decide that just one of the spouses/partners goes on the mortgage and the other doesn’t.

That can raise DTI above the 40% level even though DTI is much lower when counting both incomes. Now those borrowers will see a slightly higher rate than before.

The flip side is that high Debt-to-income adds a risk factor as “debt to income” increases.

Lenders are currently fighting this change for their own compliance reasons. It’s unclear if this adjustment will continue or go away.

New are pricing adjustments for second homes and vacation homes. These LLPAs are equal to those for investment properties.

When you see those adjustment numbers, a 1% adjustment doesn’t mean the mortgage rate increases by 1%. An internal pricing adjustment due to LLPA usually raises (or lowers) your mortgage rate by a smaller amount.

Quickly looking at loan pricing today for a 30yr fixed rate loan, I can see a 1% LLPA causing a 1/2%-5/8% increase/decrease in a generic base rate. It can be (significantly) more or less, depending on market conditions when quoting or locking a rate.

Adjustments don’t raise or lower the rate by an equal amount.

My point is that it isn’t necessarily a 1:1 relationship.

Think of it as the cost to “buy down” the loan (discount points) to get it back to the lowest base rate.

Discount Points and Lender Credits

- Discount points will be a future topic on this channel.

- It can be worth it financially to buy down a rate.

- It can be worth if financially for you to keep the higher rate.

- It can be worth it financially to take an even higher rate in return for Lender Credits

Questions to Ask Yourself When Analyzing Mortgage Quotes

Factors determining whether it’s worth it to buy down a mortgage rate or accept the higher rate include:

- Do you plan to keep the house for a few years? Or many years?

- Is it a primary home or a rental property/second home?

- Will you offer the home for short-term “AirBnb/VRBO” type rentals?

- Will you make prepayments for the principal balance? If so, how much? How often?

- Will you refinance if rates drop?

- Will the seller pay any “Buyer Closing Costs? If so, how much?

- Will you have tax benefits paying points to lower your rate?

- Do you want or need a Lender Credit?

- Should I consider an FHA or VA mortgage quote?

Loan Level Pricing Adjustments impact mortgage rates.

When receiving a rate quote, always ask what factors generated the mortgage rate proposed.

If you know your credit score has some issues, and the quote uses near-perfect credit scores, you’ll know immediately that the mortgage rate will change when your loan application is reviewed.

FHA Options

With these new Loan Level Pricing Adjustments to mortgage rates, you might be surprised to discover that an FHA loan with FHA mortgage insurance costs could be cheaper than a conforming loan without MI costs.

Contact Steve Silver at Silver Mortgage, at 1-800-920-5720.

NMLS licenses: #70160 Texas #314817 #360472 Florida #LO91968

For additional contact and licensing information, click here

© 2023 SteveSilverNow