You’re Not Going Crazy – This Happened

If your phone has been ringing nonstop since you applied for a mortgage in Houston, you’re not alone. Thousands of homebuyers deal with this same annoying and abusive problem every month.

The good news? There’s finally a solution coming. It’s called the “Homebuyer Privacy Protection Act – HR 2808”

Your Information Is Sold (Without Your Knowledge). These are called “Trigger Leads”

When you apply for a mortgage in Houston, your lender checks your credit with companies such as Experian, TransUnion, or Equifax.

Then, these credit reporting companies immediately turn around and sell your personal information to other mortgage lenders. You become a “hot lead” that gets packaged up and sold to the highest bidders.

Within hours of your credit check, your contact information is sitting in the hands of dozens of competing mortgage companies. That’s why your phone starts ringing almost immediately after you submit your application.

The crazy part? Your real estate agent and chosen lender probably didn’t sell your information. The credit reporting companies sold your information automatically, without telling you, as soon as your lender pulled your credit report.

Why Everyone Wants to Call You

You’ve just proved you’re serious about buying a home, are actively shopping for a mortgage, and have good enough credit to qualify. You’re worth a lot of money to them if they can steal you away from your original lender.

That’s why some Houston homebuyers receive over 20 calls in the first few days after submitting their application. You’re not just a potential customer – you’re a proven, qualified buyer who’s ready to borrow hundreds of thousands of dollars.

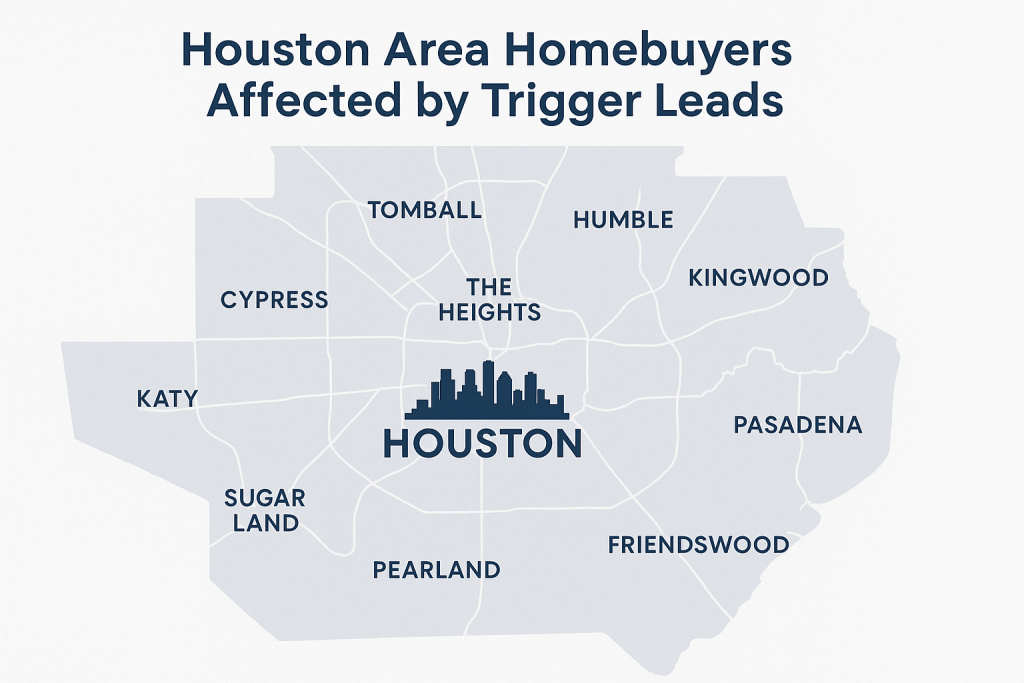

Houston Gets Hit Hard

Houston’s massive housing market creates this problem. With over 100,000 mortgage applications processed annually in Harris County alone, a constant stream of fresh leads is generated and sold. Out-of-state companies specifically target Houston buyers because they know our market is lucrative.

First-time buyers in areas like Katy and Sugar Land often get hit the hardest.

Families in The Heights reported they’re receiving calls from random companies in other states.

Sugar Land buyers get confused about which offers are real and which are just spam.

Memorial area homeowners are puzzled by the sudden surge in “urgent” refinance calls, despite never requesting them.

Good News: Help Is Coming

H.R. 2808 Will Stop This Madness

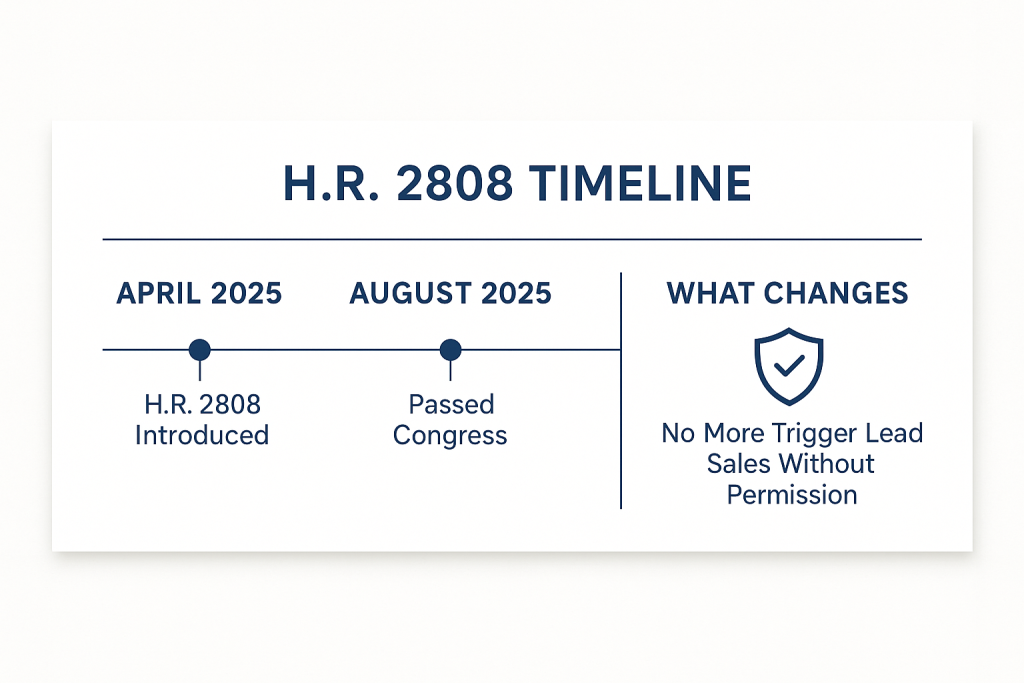

Congress has just passed a new law, H.R. 2808, known as the Homebuyers’ Privacy Protection Act. This legislation will fundamentally change how your personal information will be protected when you apply for a mortgage.

Here’s what H.R. 2808 does:

• Stops credit companies from selling your info without permission

• Only allows contact from companies you work with

• Requires your explicit consent before anyone can market to you

• Takes effect in early 2026 (6 months after the President signs it)

Once this law takes effect, the days of surprise mortgage calls will be a thing of the past. You’ll finally have control over who gets your personal information and who can contact you about loans.

Who can still contact you after H.R. 2808:

• Your current mortgage company

• Banks where you have accounts

• Companies you permitted to call you

Who CAN’T contact you:

• Random mortgage brokers who bought your info

• Out-of-state companies you never heard of

• Anyone you didn’t specifically say “yes” to

What You Can Do Right Now

While we wait for H.R. 2808 to take effect (6 months after it’s signed into law), you don’t have to suffer in silence. There are steps you can take today to reduce these annoying calls and protect yourself in the future.

Stop the Current Calls

Document everything:

• Write down company names and phone numbers

• Save voicemails as proof

• Note the time and date of each call

Fight back:

• Tell them to remove you from their list immediately

• Ask for their license number and company info

• Report aggressive callers to the Texas Department of Savings and Mortgage Lending

Don’t be polite with these companies. They purchased your information without your permission, so you owe them nothing. Be firm, be direct, and insist on their removal from the lists.

Protect Yourself Going Forward

When you’re choosing a Houston lender, privacy should be one of your top concerns. The right mortgage company will respect your personal information and never participate in these lead-buying schemes.

Ask potential lenders:

• “Do you sell my information to other companies?”

• “What’s your privacy policy?”

• “Can you promise my info stays private?”

Red flags to avoid:

• Companies that contacted you through these spam calls

• Lenders who won’t explain their privacy policy

• Anyone pressuring you to “act now”

How to Find Privacy-Focused Houston Lenders

Questions That Matter

The mortgage industry is full of companies that will say anything to get your business. However, when it comes to protecting your privacy, you need to ask the right questions and receive genuine answers.

Ask these specific questions:

• “How do you protect my personal information?”

• “Do you share data with other companies?”

• “What happens to my info if I don’t choose you?”

• “Can you put your privacy promises in writing?”

Good lenders will provide you with precise and honest answers without hesitation. They’ll put their privacy promises in writing and never pressure you or use scare tactics. Most importantly, they’ll focus on helping you rather than just trying to sell you something.

What This Means for Houston Homebuyers

The Future Looks Better

Once H.R. 2808 takes effect in 2026, the entire mortgage experience will improve for Houston homebuyers. No more surprise calls after applying for mortgages. Less stress during an already stressful process. More time to focus on finding the right home instead of dealing with pushy salespeople.

You’ll be able to build better relationships with your chosen professionals because you won’t be constantly wondering if they sold your information to competitors.

Choose Wisely Now

While we wait for the new law, you can still protect yourself by working with Houston mortgage companies that already respect your privacy. Look for lenders who don’t participate in buying and selling lead lists, have clear privacy policies, and prioritize your interests.

The best mortgage companies build relationships, rather than just chasing sales. They understand that your trust is more valuable than any quick commission they might make by selling your information.

Bottom Line

Being bombarded with calls after applying for a mortgage can be incredibly frustrating, but it’s not your fault. H.R. 2808 will resolve this issue permanently, starting in 2026. Until then, be smart about who you work with and don’t be afraid to hang up on companies that bought your information.

Your mortgage process should be about finding the right home and the right loan – not dealing with a bunch of strangers who bought your phone number from a credit reporting company.

Key takeaways:

• This happens to thousands of Houston homebuyers

• Credit companies sell your info automatically

• H.R. 2808 will stop this practice in 2026

• You can protect yourself by choosing privacy-focused lenders

About Silver Mortgage

We’ve never sold client information to other companies, and we never will.

At Silver Mortgage, your privacy matters as much as getting you the right mortgage for your Houston-area home.

Ready to work with a lender who respects your privacy? Contact us today.

About Steve Silver, Licensed Mortgage Professional

Steve Silver has been helping clients in Houston, Dallas, Tampa Bay, Orlando, and Colorado secure mortgages for over 40 years.

At Silver Mortgage, we prioritize your privacy and never sell your personal information to other companies.

Ready to get started?

• Call: 1-800-920-5720 or 281-362-8886 Text: 719-626-1466 E-Mail: info@SilverMortgage.com

• Free pre-qualification: Mortgage Calculator and Online Application

• Privacy-focused mortgage quotes: Available in TX, FL, and CO (New Mexico 4th Qtr 2025)

Licensed in: Texas (NMLS #314817, #360472, #70160) | Florida (NMLS #LO91968) | Colorado (NMLS #100538170)

For additional contact and licensing information, click here.

Last updated August 2025. Laws and regulations change – get current advice from qualified professionals.