By Steve Silver, NMLS #314817 | August 22, 2025

NOTE>>>THIS ARTICLE IS NOW OUTDATED AND WILL BE UPDATED SOON.

Texas SB 140 Quick Summary*

• New Texas law (SB 140) takes effect September 1, 2025 – stops unwanted SMS marketing.

• Companies must get your permission first before sending promotional text.

• You can sue for $500-$5,000 per violation – plus attorney fees and triple damages.

• Works with federal trigger lead restrictions to protect mortgage borrowers • Choose privacy-focused mortgage professionals to avoid problems.

If you’re shopping for a mortgage in Dallas, Houston, or anywhere in Texas, there’s a new law taking effect September 1, 2025, that will change how mortgage companies can contact you via text message. Texas Senate Bill 140 gives you control over who can send you marketing texts and creates real penalties when companies break the rules.

As a mortgage professional with over 40 years of experience serving Texas borrowers, I’ve seen how aggressive marketing tactics overwhelm homebuyers during what should be an exciting time. The new Texas SMS rules, combined with federal efforts to stop predatory mortgage marketing, represent a shift toward protecting your privacy and ensuring a better mortgage experience.

Trigger Leads

If you’ve applied for a mortgage and suddenly started getting dozens of unwanted calls and texts, you’re not alone. This happens because of something called “trigger leads” – when credit bureaus sell your personal information to other lenders the moment your mortgage company checks your credit.

Here’s how it works:

1. You apply for a mortgage with your chosen lender

2. They pull your credit report from Experian, TransUnion, or Equifax

3. The credit bureau immediately sells your info to other mortgage companies

4. Within hours, competing lenders start calling and texting you

Some Dallas and Houston homebuyers received over 20 unwanted contacts in the first few days after applying, particularly with Houston SMS marketing campaigns targeting recent mortgage applicants. You become a “hot lead” that gets sold to the highest bidders.

The crazy part? Your real estate agent and chosen lender probably didn’t sell your information. The credit bureaus sold it to your lender without your knowledge, as soon as they pulled your credit report.

Learn more about why you’re getting so many calls after applying for a mortgage in Houston.

What Texas SB 140 Changes

Texas Senate Bill 140 is often called a “Mini-TCPA” law because it extends federal phone protection rules to text messages. Starting September 1, 2025, businesses that send promotional texts to Texas residents must follow strict new rules as part of comprehensive Texas mortgage compliance requirements.

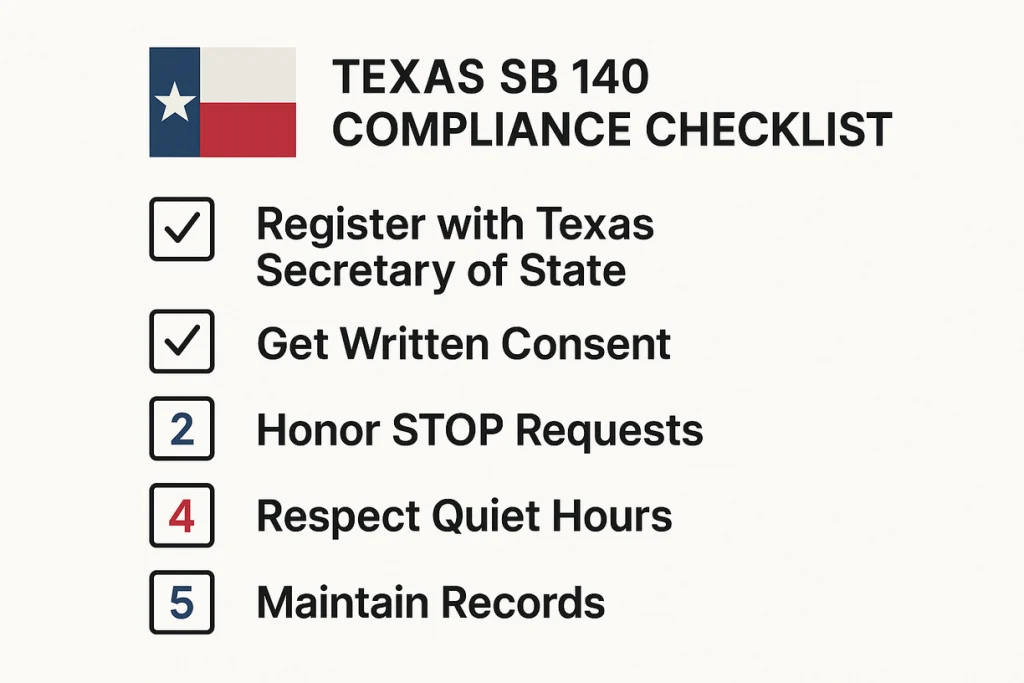

Registration Requirements

Companies must: • Register with the Texas Secretary of State as telemarketers • Pay a $200 annual fee • Post a $10,000 security bond • Submit quarterly reports • Display registration certificates on their websites.

Consent Requirements

Before sending any promotional texts, companies must: • Get your explicit written permission (no pre-checked boxes) • Clearly explain what messages you’ll receive • Provide easy opt-out instructions in every message • Honor “STOP” requests immediately • Respect quiet hours (likely 9 AM to 9 PM)

Who’s Exempt

These companies can still contact you without registration: • Your current mortgage lender or broker • Banks where you have accounts • Companies you specifically gave permission to contact you • Publicly traded companies and regulated financial institutions.

Real Penalties That Matter

Unlike many consumer protection laws, Texas SB 140 lets you sue companies directly without filing government complaints first. The penalties are designed to hurt and address TCPA violations Texas residents have long endured:

• $500 to $5,000 per violation

• Triple damages for willful violations (up to $15,000 per text)

• Attorney fees and court costs • Mental anguish damages • No limit on successive lawsuits for repeat violations

If a company sends you three unwanted texts, you could recover $1,500 to $15,000 plus attorney fees.

Federal Help Is Coming Too

Congress passed the Homebuyers Privacy Protection Act (H.R. 2808) to stop trigger leads at the source. Once signed into law, credit bureaus can’t sell your mortgage information unless: • The company already has a relationship with you, OR • You specifically opted in to receive offers.

Combined with Texas SB 140, these laws will eliminate most unwanted mortgage marketing while protecting legitimate business relationships.

What You Can Do Right Now

Stop Current Unwanted Texts

• Document everything – save messages, note company names and times • Respond with “STOP” to opt out immediately • Report violations to the Texas Attorney General • Consider legal action if companies ignore your opt-out requests

Protect Yourself Going Forward

• Ask mortgage professionals about their privacy policies • Avoid companies that contacted you through spam texts • Choose lenders who don’t buy trigger leads • Get privacy promises in writing • Consider freezing your credit as an additional privacy protection measure

Questions to Ask Potential Lenders

• “Do you buy trigger leads or lead lists?” • “How do you protect my personal information?” • “What’s your policy on sharing data with other companies?” • “Can you put your privacy promises in writing?”

Understanding what a FICO score is also helps you prepare for the mortgage process and understand when your credit is being checked.

Finding Privacy-Focused Mortgage Professionals in Texas

The new law creates advantages for mortgage professionals who have always respected consumer privacy. Dallas mortgage privacy has become increasingly crucial as borrowers seek professionals who protect their personal information. Look for professionals who:

• Have established local reputations in Dallas, Houston, or your area • Work primarily with referrals rather than purchased leads • Clearly explain their communication practices upfront • Provide written privacy policies • Focus on education rather than high-pressure sales tactics

If you’re shopping for homes, check out our Houston neighborhood research for the best areas to focus your search.

Red flags to avoid: • Companies that contacted you through unwanted texts or calls • Lenders who won’t explain their privacy policies • Anyone pressuring you to “act now” • Professionals with complaints about aggressive marketing

Learn about medical collections and mortgages if you have medical debt that might affect your mortgage application.

The Bigger Picture

Texas SB 140 represents more than just a new law – it’s part of a movement toward recognizing that consumer privacy is a fundamental right. When you can shop for mortgages without harassment, when mortgage professionals compete on service quality rather than marketing aggression, and when the process operates with respect for your preferences, everyone benefits.

For Texas mortgage borrowers, this creates unprecedented tools and protections. By understanding your rights, choosing privacy-focused professionals, and holding companies accountable for violations, you can help ensure the mortgage process serves your interests.

Key Takeaways

What’s Changing:

• Texas SB 140 takes effect September 1, 2025

• Companies need your permission before sending promotional texts

• Real penalties of $500-$5,000 per violation, plus attorney fees

• Federal trigger lead restrictions are also coming

What You Should Do: • Document any unwanted texts you receive after September 1 • Choose mortgage professionals with strong privacy policies • Ask direct questions about data sharing and marketing practices • Know you can sue companies that violate the new rules.

Bottom Line: The days of unwanted mortgage marketing texts are ending. Companies that respect your privacy will thrive, while those that don’t will face serious consequences. As a Texas mortgage borrower, you now have the tools to control your experience and work with professionals who put your interests first. This comprehensive Texas homebuyer protection ensures your mortgage journey is based on your choices, not aggressive marketing tactics.

About Steve Silver: 43 years of experience in all aspects of mortgage lending, development, management, and construction.

About Silver Mortgage (a Privacy Focused Mortgage Company)

We’ve never sold client information to other companies, and we never will.

At Silver Mortgage, your privacy matters as much as getting you the right mortgage for your Houston-area home.

Ready to work with a lender who respects your privacy? Contact us today.

About Steve Silver, Licensed Mortgage Professional

Steve Silver has been helping clients in Houston, Dallas, Tampa Bay, Orlando, and Colorado secure mortgages for over 40 years.

At Silver Mortgage, we prioritize your privacy and never sell your personal information to other companies.

*Content provided for information purposes only and not guaranteed to be accurate at the time you are reading this article.

Ready to get started?

• Call: 1-800-920-5720 or 281-362-8886 Text: 719-626-1466 E-Mail: info@SilverMortgage.com

• Free pre-qualification: Mortgage Calculator and Online Application

• Privacy-focused mortgage quotes: Available in TX, FL, and CO (New Mexico 4th Qtr 2025)

Licensed in: Texas (NMLS #314817, #360472, #70160) | Florida (NMLS #LO91968) | Colorado (NMLS #100538170)